Innovation outposts as effective ways of ingesting innovation into corporate ecosystems

The boundaries between a company and its operating environment have diluted. Innovations can be easily transferred inward and outward between firms and other firms and between a firm and its creative consumers. This translates in impact at the consumer level, the firm, the whole industry and society.

Today, there is a growing tendency in big companies to operate disruptive ideas far away from their headquarters in the so-called “innovation outposts”, where they afford to increase their versatility and be fast enough to keep up with such a demanding pace in technology.

The term “open innovation” is most recently defined as “a distributed innovation process based on purposively managed knowledge flows across organisational boundaries, using pecuniary and non-pecuniary mechanisms in line with the organisation’s business model”. Open innovation is not related solely to the company, it also includes creative consumers and communities of user innovators.

Innovation Outpost

A report from Mind The Bridge – an advisory firm in innovation – and JETRO (Japan External Trade Organisation) observes the corporate’s new ways to push towards innovation strategically placing their innovation outposts inside the world’s tech epicentres: San Francisco Bay Area, Israel or China. According to their methodology, an “innovation outpost” is “a team of people and often a physical site that is set up by a corporation in a global technology hub to perform/support activities of: Technology Scouting, Open Innovation, Startup Investments, and M&As”. The main purpose of an innovation outpost might be:

- Exposure/Training

- Trend Reporting

- POC/Acceleration/Co-Development/Development/Venture Building

- Procurement/Licensing/Partnership

- Investments

- Acquisitions

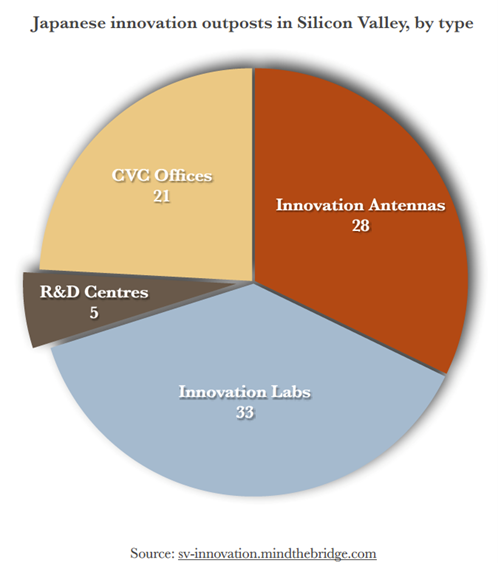

During their operation, innovation outposts are constantly changing shape, from being innovation “antennas” for the head company to independent R&D centres. Japan, in particular, uses this innovation outposts for capital deployment in the form of either Corporate Venture Capital (CVC) or Limited Partners in a tertiary investment fund.

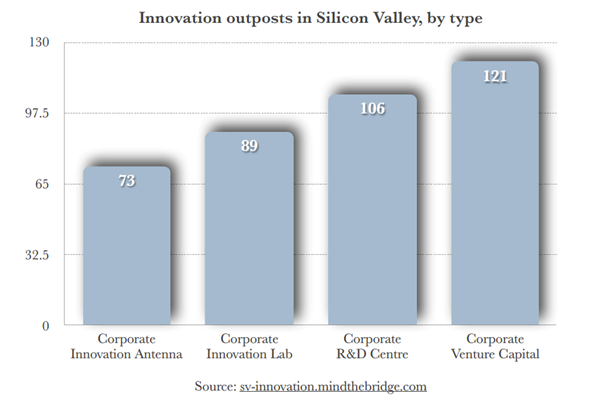

According to Mind the Bridge and JETRO classification, there are four different types of innovation outposts, based on their parent-corporate’s mission:

- Corporate Innovation Antenna

A lean setup consisting of a small team up to 10 individuals performing trend spotting and individual startup engagement. This is usually the initial step of a corporate starting to grow a presence. Typically, the Antenna is hosted in a co-working space or third party innovation centre.

- Corporate Innovation Lab

This represents a startup incubator or accelerator running on corporate resources for out-of-house research and development on new technologies but also venture building and strategic partnerships.

- Corporate R&D Centre

Used for in-house research & development on new technologies. This kind of outpost is established when there is a long-term commitment from the main company. An R&D centre employs anywhere from 50 to 500 individuals, many of them as local talent.

- Corporate Venture Capital (CVC)

Venture Capital is organically part of an entrepreneurial ecosystem, therefore a physical CVC office is often the choice of a big corporations inside an innovation cluster.

Real-time Data

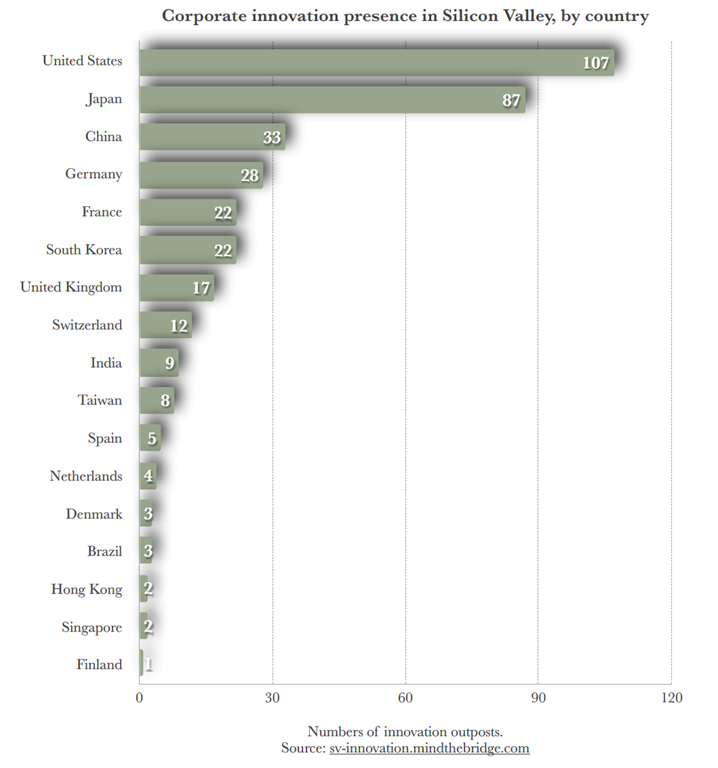

Mind the Bridge Online Directory, shows real time data of the innovation ecosystem in Silicon Valley. According to their numbers, in November 2020 there were a total of 389 innovation outposts in the Bay Area taking the form of either innovation antennas, innovation labs, R&D centres or venture capital offices.

Out of these, 27% (107) were American companies, 22% (87) were Japanese, followed by Chinese (33), German (28), French (22) and Korean (22). The top 6 countries with innovation related operations account for 76% of the total number of corporates, while there is a total of 30 countries with innovation hubs in the Bay Area.

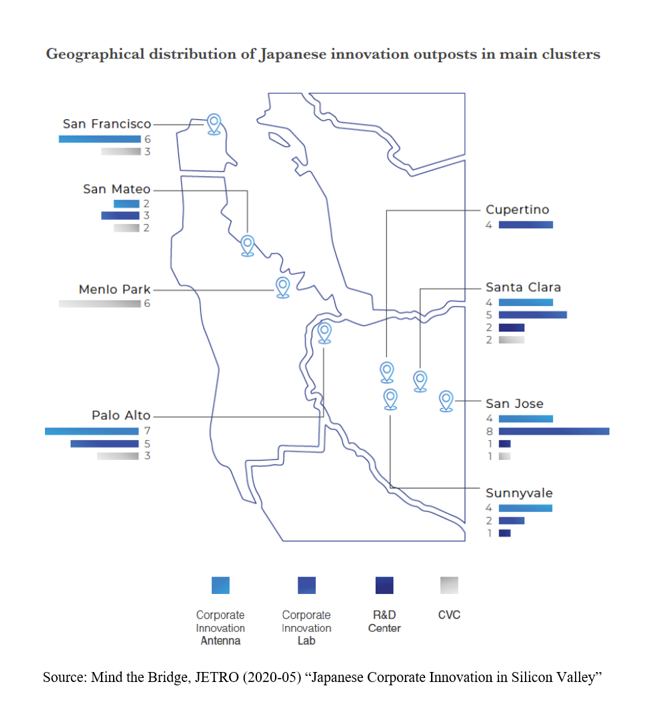

If we look strictly at Japanese presence in the region, we see a tendency towards lean structures as antennas, labs and VC offices, operating on a small number of employees.

There are only 5 more structured Japanese R&D subsidiaries established in Silicon Valley that deliver innovation for their main branch: Fujitsu Laboratories of America (FLA), Hitachi America and Hitachi Vantara, Toyota Research Institute and TDK InvenSense. These R&D centres have operations that require anywhere between 50-500 members of staff and have their research focused on artificial intelligence, sense computing, cryptography, blockchain, big data analysis, IoT or quantum computing.

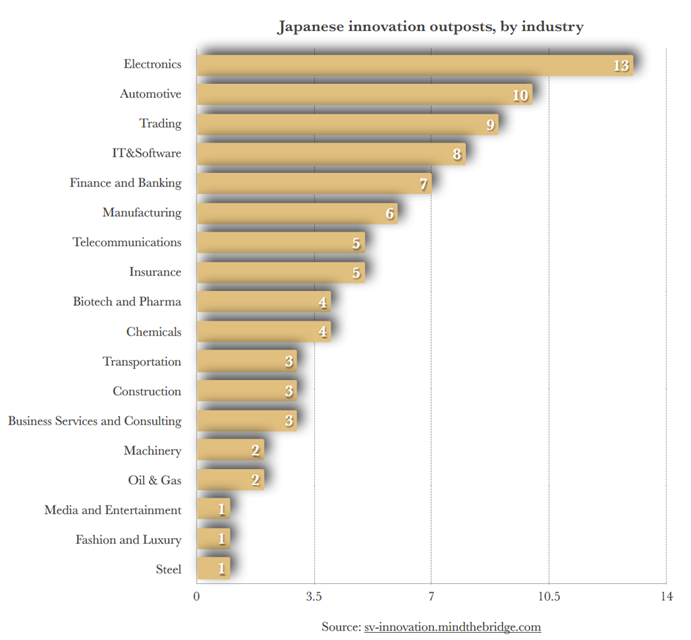

Japanese Sectors in Silicon Valley

Regarding the industries, there are 18 different sectors of the Japanese economy present in the Bay Area, some companies having more than one innovation outpost. The most representative sector is Electronics, counting 13 outposts out of the 87 and covering giants such as Panasonic (3), Sony (2), Hitachi (2), Canon (1) or Murata (1).

The Automotive industry comes next with 10 innovation centres for manufacturers such as Toyota (2), Denso (2), Honda (1) or Yamaha (1). Large conglomerates as Mitsui, Mitsubishi and Sumitomo, which have their main focus on trading and investing, are also key players in the region having 9 CVCs and innovation labs to cover their extended portfolio of research and investment. Software comes next with 8 Japanese innovation antennas and corporate innovation labs working for Fuji Film, Rakuten, Softbank and NTT.

Establishing innovation satellites away from the headquarters is considered a strategic move for a corporation looking to remain at the forefront of societal transformation. If there were only 10 Japanese innovation outposts tracked by Mind the Bridge before the year 2000, the number grew almost 9 times, especially in the last 5 years.

Today’s data shows Japan being the foreign country with the largest innovation presence, spread all around Silicon Valley.

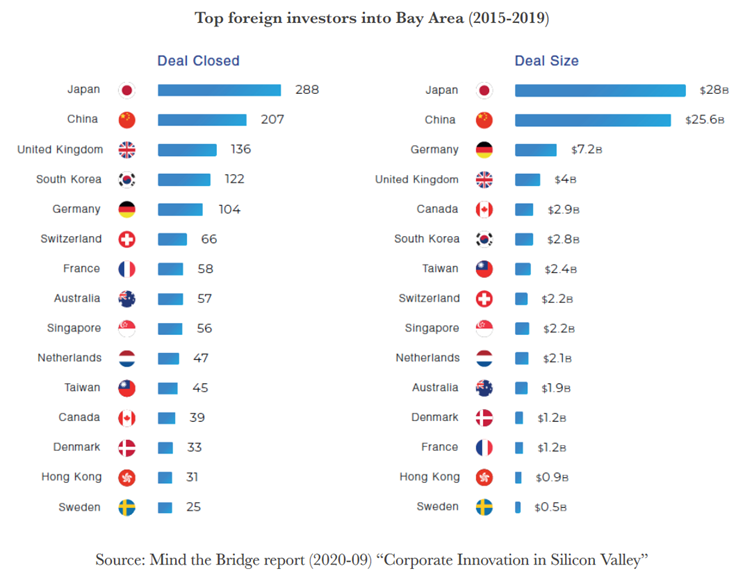

Not only the presence but also the capital invested by Japanese companies in the region is significant. Starting from 2015, corporates in mainland Japan put a special focus on CVC (Corporate Venture Capital), backing 288 rounds with a total of $28B of co-investment into the Bay Area. This makes Japan the most valuable foreign investor in Silicon Valley. The main players in the spectrum are the Vision Fund, Toyota AI Ventures, NTT Docomo Ventures, Sony Innovation Fund and MUFG Innovation Partners.

According to cited research’s observations, corporate innovation outposts’ success depend on their alignment with the goals of their main companies and the business units that have to integrate the innovation coming from Silicon Valley. If the teams are stable and the commitment from top management is clear, concrete results follow, independently of the headcount in the Bay Area.

About Mind The Bridge

Mind the Bridge is a global organisation that provides innovation advisory services for corporates and government organisations. With HQs in San Francisco (CA) and offices in Barcelona, London, Milan and Berlin, Mind the Bridge has been working as an international bridge at the intersection between Startups and Corporates since 2007.

Mind the Bridge scouts, filters, and works with 5,000+ startups a year supporting global corporations in their innovation quest with open innovation initiatives that translate into curated deals with startups (licensing, investments, and/or acquisitions). It also provides advisory services and benchmarking on innovation strategy and structure. Find out more at mindthebridge.com .

About JETRO

JETRO, or the Japan External Trade Organization, is a government organisation that works to promote mutual trade and investment between Japan and the rest of the world. JETRO San Francisco focuses on Innovation, and partners with local accelerators for startups to provide free services which allow them to expand their business and receive expert mentoring. JETRO also connects Japanese startups to interested investors in the Bay Area and provides support and assistance to American companies entering the Japanese market. Find out more at: jetro.go.jp/usa/