Business analysts guide and help organizations improve processes and systems, product, service offerings, and software used in the business. In digital transformation projects, they serve as the bridge between the business department and the technical solution delivery team.

They gather the process requirements, analyze information to create the process documentation, and specify the business scenarios, known exceptions and handling rules, existing process restrictions and dependencies, and any other information related to the project.

More importantly, they are responsible in quickly identifying and assessing resistance and preparing, supporting, and successfully adopting changes in order to keep the projects on track and moving forward.

For Joselle Varela, the role has become one of the most critical positions that shape the success of technology transformation initiatives and the future of many businesses.

Joselle Varela has led various RPA projects in different industries.

Background

Joselle has led RPA projects as a business analyst and project manager across different domains and industries. Her initial foray into RPA started when she became part of an operational excellence team for a global financial company.

“Our overall objective was to evaluate various areas and functions of the business and assess teams and processes to see areas of improvement.”

“As a business analyst, I was tasked to find gaps and redundancies present in the department and to come up with solutions to resolve or correct the symptoms of a problem. Upon reviewing all the business objectives, processes, and failure cost mechanisms, I saw the non-critical and repetitive items in the financial sector. We brainstormed different approaches and looked at existing and upcoming technologies. During that time, one of the highest-ranking solutions was RPA, which we further explored.”

Invoice processing is one of the use cases of RPA in finance. Source: Information-Age

RPA Applications

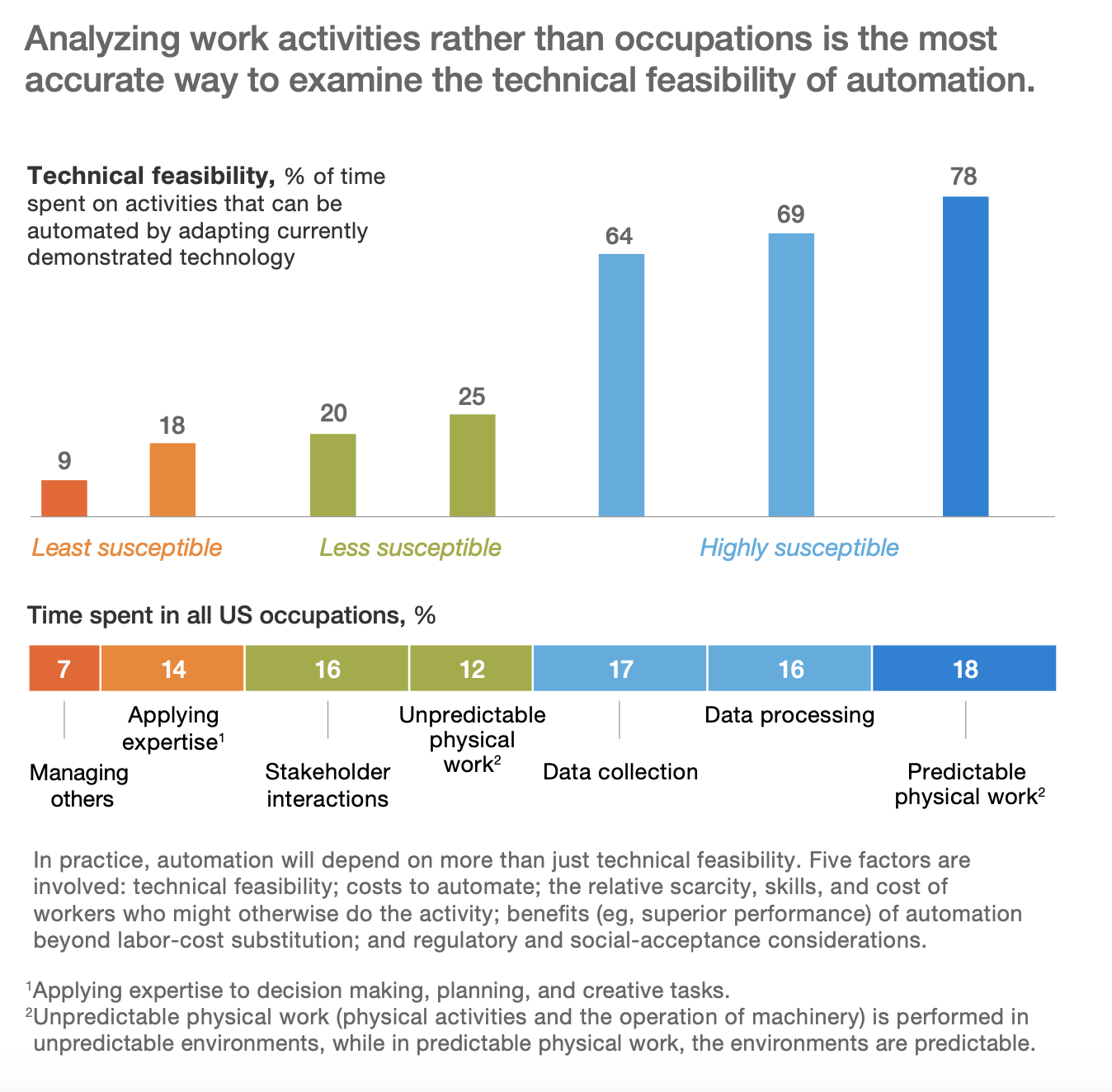

In a report by McKinsey & Company, the finance and insurance industry had a 43% technical potential of automation, with data processing as the activity type getting automated the most.

“Both the financial and industrial sectors need RPA to some extent.”

“Financial industry is more of an operational imperative. In finance, there are lots of bureaucracy, lots of red tape, and long processes to complete a transaction. The time it takes to do something is actually so much longer than it should actually take.”

”It was an operational imperative because there are ways to improve or shorten the length of these business processes.

Joselle VarelaDigital Transformation Consultant

“The industrial sector, on the other hand, is more of a strategic imperative. It is a slow-moving sector in terms of processes and technology because everything has to be stable, since quality is important.

Joselle further explains, “Even if you have the same set of products, you have to have your differentiation strategy. RPA helps achieve this by automating the manual processes from multiple data sources that employees do on a regular basis. For example, engineers can save time from getting data from disparate sources – existing applications in the company, websites, spreadsheets – since the data ingestion alone takes a lot of time.”

“As a result, employees can focus on more complex transactions or high value tasks.”

Predictable physical work, data processing, and data collection have the highest potential of automation. Source: McKinsey & Company

Challenges

Admittedly, Joselle’s initial pitch for RPA wasn’t well received.

“Looking back, my first pitch could have taken a different road had I not talked about RPA as a technology in itself, like the benefits and functions. It received a lot of questions.”

Joselle and her team had to go back to the drawing board and ask how they could make it happen. Her team made a second pitch, this time, using a different approach.

“Essentially, we contextualized it within the operational excellence team and explained that our objective is to deliver operational excellence initiatives. We started out by pointing the processes, the pain points, and potential savings that we can have when we correct these processes.”

Saving time and money, increased compliance, and more time spent with customers are some of the benefits of RPA in the finance industry. Photo by Mimi Thian on Unsplash

“On top of the financial benefits, process and quality improvements, and speed, we also talked about how RPA can empower people to do more productive and more critical activities that they are expected to do for the company and for themselves.”

”Since RPA was quite new and groundbreaking, the biggest challenge was the fear of the unknown. RPA, during that time, was unheard of so there was a lot of rejection.

Joselle VarelaDigital Transformation Consultant

“Also, there were questions on how quickly it can be delivered or speed to market with that technology was another concern.”

“From a deployment standpoint, my impression of RPA is it’s a digital IF and ELSE statement. And the challenge with that premise is how do you transfer implicit knowledge to explicit knowledge. Because when you design your RPA, it’s knowing basically everything – all the logical steps, processes, and countermeasures supposing you encounter problems.”

“For the financial sector, not everything is documented. And more often than not, it’s based on what the person knows or what your senior employee knows. How do you throw an implicit knowledge to explicit knowledge and how do you cover all critical bases would be another challenge.”

Overcoming challenges and fears

If there’s one thing that Joselle’s years of experience has taught her when it comes to overcoming challenges related to RPA deployments, it has to be change management.

“An important component of change management is communication. It’s about talking to your stakeholders. Talk to them and get the requirements. Understand what their priorities are, and what their fears are for you to effectively implement a digital solution. Technology innovation programs affect people, so you have to know what they REALLY have in mind.”

When asked about typical questions that she had to deal with regarding RPA, Joselle shares the following:

- Can the robot really do my job?

- It does some parts of my job, what am I going to do with it now?

- If there is a clash with the robot, what should we do?

- What would be the next steps, meaning, what would the actual jobs of the employees be?

“The first question is more of a suspicion. What does the robot know? Can it really do my job? This was quite common.”

”And I would always say – the robot is as smart as you make it to be. Because the intelligence of the robot depends on your intelligence or the intelligence that you want to put into it.

Joselle VarelaDigital Transformation Consultant

“And I feel that when you make an unknown situation a bit more familiar — bridging two resources together: the human and digital — it makes the situation a little bit easier to digest or to swallow.”

“It is not humans versus robots. It’s the kind of team that the humans and robots create where robots complement what humans are doing as opposed to replacing them.”

When asked if RPA is an effective use of resources, Joselle opines:

“It should be. But it can also not be. In principle, yes.”

“But if it is not executed well, if there’s not enough change management done, it is not going to be an effective use of resources.”

Change Management in the Digital Age. Source: BankingHub

“I have seen a case where they put the software robot, but nobody understands how the robot works. So, they were taking the job from the robot, instead of getting the job done. Efforts were duplicated, creating more problems, so it is not very efficient, in that example. So if you are not able to work on your building blocks, then it is not an efficient use of resources.”

“Another example is if you did not do process improvement before RPA. When you do a digitalization initiative, you have to identify the symptoms and correlate them with the right problem and fix the problem. We never want to run the risk of digitizing inherent problems or complications.”

”Because the moment you put digital or automation on top of what you are doing without fixing the problem, you are digitizing 100x of the problem.

Joselle VarelaDigital Transformation Consultant

“You have to fix the problem. That is very important. I feel that it is common sense that is not common especially in light of digitalization.”

“Everybody says digitize, digitize, digitize. But it is not just about digitizing things. It is about doing your due diligence which is looking into both qualitative and quantitative aspects. And then executing stage by stage for you to realize the full value.”

Digital Transformation: Best Tip

For organizations that are embracing digital transformation or are implementing technology innovation programs such as RPA, Joselle’s advice is:

“Always take a step back, assess the operational context, look at the problem, identify the inherent problems, know your risks, align your priorities, align your goals, then fix the problem. This sounds like too many steps, but these are all necessary.”

“Ensure that whatever processes you have are robust enough so when you move to the next step, which could be digitalization, it is going to augment the value of the improvement that you have had. Digitalization is there to help you progress it.”

“More importantly, integrate people to people, process to process, technology to technology. Having that approach to any automation initiative makes things more sustainable and makes value tangible.”

“Ensure that the value is felt horizontally, and vertically, and that everyone is aligned. So even when a person is gone or leaves the company, other people still know what to do,” Joselle concludes.

Main image by: Call Center Helper