When disaster or other uncertainties strike, an insurance policy can help individuals, businesses, and organizations mitigate the impact of any substantial financial loss. It was said that life insurance dates as far back as the 600 BC when the Greeks and Romans introduced the concept of “benevolent societies” which cared for the families of deceased members. During the 17th century, when ships sailed to the New World, multiple investors would fund these voyages in order to spread the risk.

Given its long history, how does the insurance industry continue to remain relevant and resilient? How is the industry innovating today and how has the pandemic affected its business model and processes?

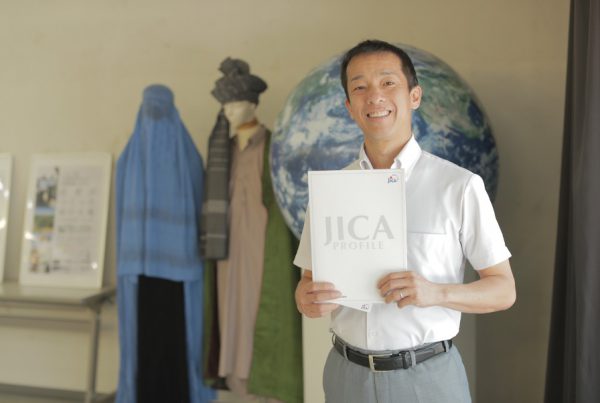

For these questions, I reached out to Naohiro Mouri, Executive Vice President and Chief Auditor at AIG and first President of the Asian Confederation of Institutes of Internal Auditors from 2001 to 2006. He was also the 2018-2019 global Chairman for the Institute of Internal Auditors, the only global internal audit professional association with over 200,000 members in 120 countries around the world.

Overview of the industry

“So as you said it correctly, insurance has been around quite some time from the days of Christopher Columbus. During that time, people were actually betting on the exploratory voyage. Lloyd’s Coffee House (later called Lloyds of London came up with the idea of collective risk taking. Lloyds offered exploratory maritime insurance after seeing the need in the market. And that is really the beginning of insurance,” Mouri begins.

“So it’s been around for 300 years, 400 years at least.”

Insurance provides a monetary opportunity when a contractual event happens.

“For example, in life insurance, if someone dies, the money is distributed based on the contract to those who survives. In property and casualty insurance, if peril hits a like typhoon or fire, and you lose property or your house or your business, there is a monetary compensation based on the contract. So everything is actually based on contract and that sets the terms and conditions of how you will receive money from the insurance company.”

“So if you think about that, anything can be insured. It’s not just your house, your jewelries, your properties, your paintings, it can be anything.”

Meeting the moment

With a variety of shifting forces playing out in today’s world and has an industry that has remained resilient for hundreds of years, the industry continues to become relevant by focusing and adapting to the changing needs and behaviors of the customers.

“Today, we have increased digitalization. And organizations that have embraced new technology (like cloud analytics and IoT) see the need for products such cyber insurance.”

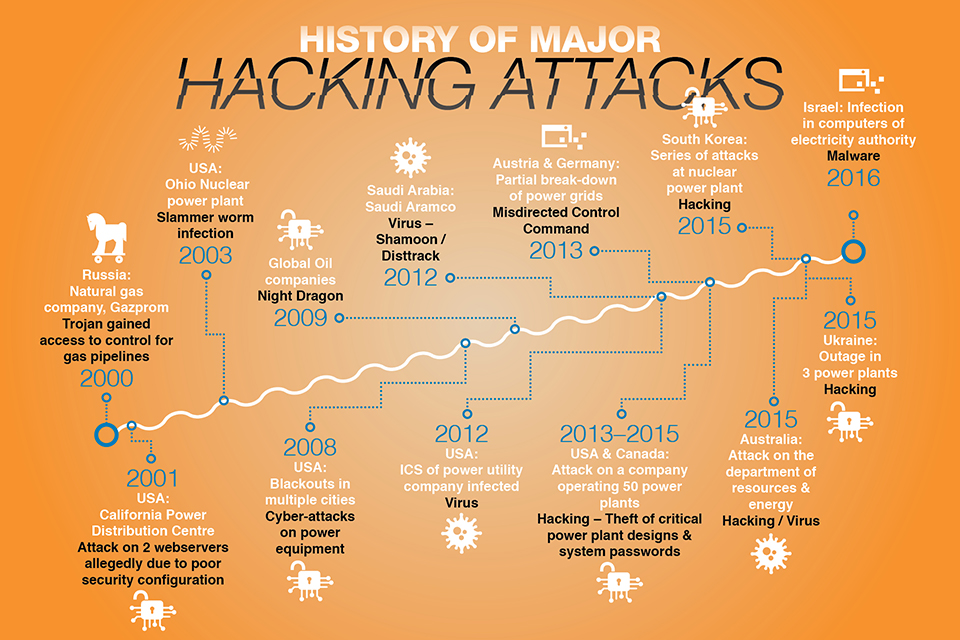

“So, in case companies or individuals get hit by a cyber incident, and mostly this is on the corporate side, they lose data and there is a reputational risk to the business. Then they need someone to cover the cost of the risk, so we do insure cyber incidents. And if you think about cyber, this actually has lots of implications,” Mouri explains.

“Let’s say a nuclear power plant is hit by a hacker, and they take over the control. That can have widespread impact because virtually all industries rely on electric power and fuels and have some dependence on the energy sector. If this incident causes property damage to the power plant, by setting fire, for example, you may ask: is that incident potentially covered by the property insurance or the cyber insurance? We can actually cover the incident by both policies depending on its terms and conditions.”

An overview of major cyber attacks on power plants and power grids. Image Source: Wartsila

“When you think about it, anyone and anything can be insured as long as you can set the right value. And then there’s a contractual term and condition can be set. Also you need to be paid for taking the right risk.”

And as the COVID-19 crisis continues, the industry has also taken steps to address the challenges and needs brought about by the impact of the pandemic on individuals and businesses.

“If you think about how the means of transportation is changing, we evolved from ship to freight or railroad to airplane. And now, because of COVID: bicycle. So, if you think about all of that, that can be insured. And there’s a lot of bicycle incidents that are happening lately, because more and more people actually ride bicycles as opposed to cars. No one travels by airplane now, right?”

COVID-19 brought a dramatic increase in bicycle usage. As more and more people refrain from taking public transportation, more consumers turned to bicycles as a means of exercise and a form of mobility that helps them avoid unnecessary contact with others. Image Source: UN.org

“And then, because of staying at home, more people buy pets like dogs, cats, and those need to be insured as well, just like humans. So there’s a medical insurance for pets, which actually can be very expensive.”

“In Japan, the social medical insurance or private medical insurance coverage can cover your needs. But pets are generally not covered by them, and that’s actually a big area for new insurance.”

“Clearly Japan is not a litigious society yet, but you know, more and more, we see class action lawsuits against directors and officers of the company when they make the wrong decision such as the failure to uncover large corporate fraud cases. So, we do actually insure those directors and officers in case they’ve been asked to pay large amount of penalties. And then we also ensure that legal cost associated to that, which can be quite expensive as well.”

Evolving the business processes

Before the pandemic, buying insurance can be done with an agent, or by going to a “houken-no-madoguchi” (insurance window). Customers sit down and sign a piece of paper.

“But you can’t do that in a COVID environment. So we had to actually digitize that process. That changed the behavior of the consumer as well.”

For Naohiro Mouri’s team at AIG, the pandemic only sped up this process.

”One is that we decided what not to do. For example, we stopped distributing all paper-based policies but to scan only the documents that are critical documents to satisfy the requirements for customers and regulation, reducing the process to the bare minimum. And thiscompletely changed the way we actually do things. We don’t need as many people in the mailroom. And then people who actually received those mails don’t have to read as many mails in the past.

Naohiro MouriExecutive Vice President and Chief Auditor at AIG

“As a result, it brought positive changes to the process. That’s one thing.”

“Another is the use of digital signatures. Obviously, people cannot physically sign insurance policies these days. We had to go very quickly to implement DocuSign or Adobe Sign for us to actually continue to operate. So we did change the process and implementedthose applications. And then we actually had to work with our agents, for them to be trained on how to use those tools so they cancontinue to sell the insurance policies. So implementing new applications, training people, and changing controls. We had to adjust and adapt the control accordingly,” he stresses.

Areas of growth

In terms of global growth drivers, there are two equally important pillars of growth, each requiring a different approach for Naohiro Mouri.

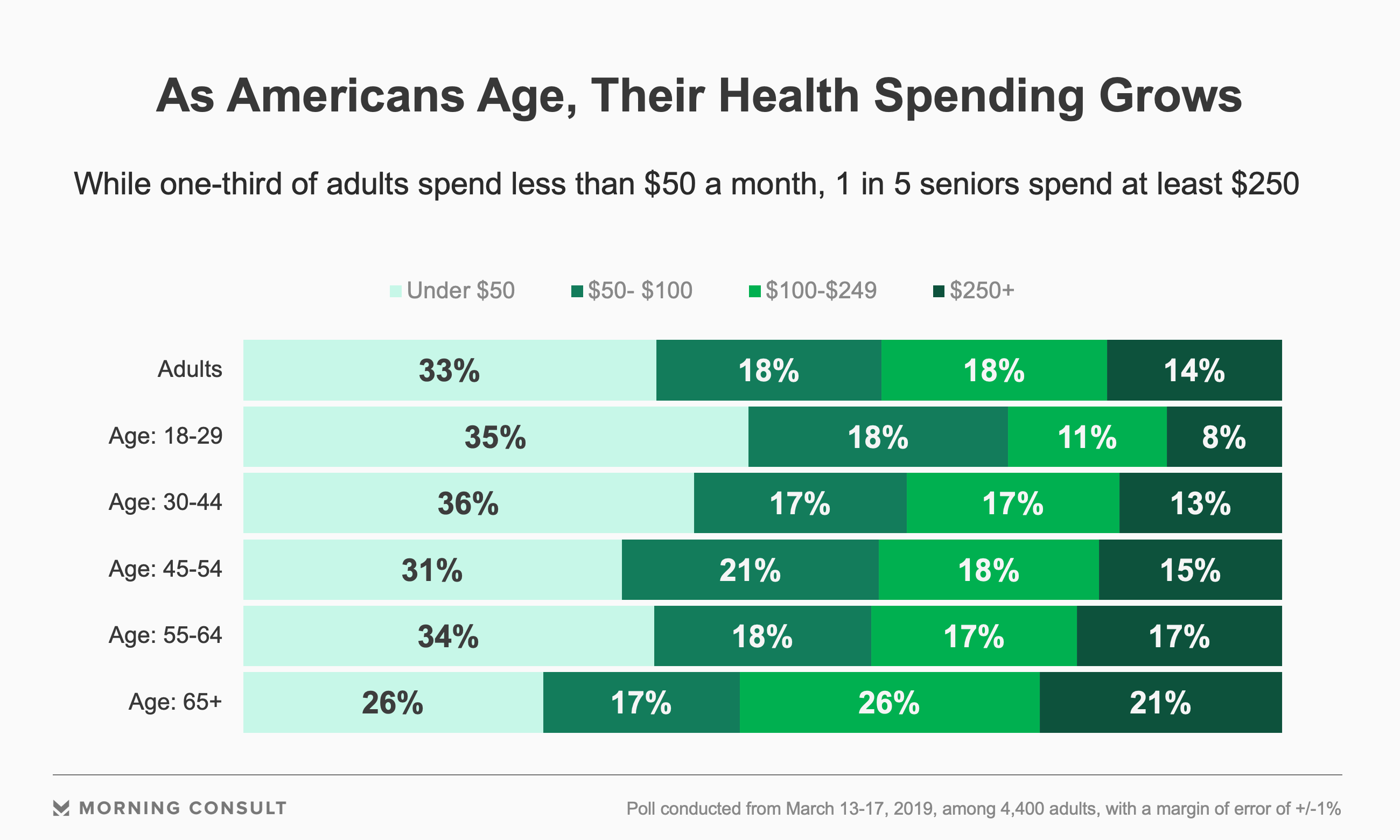

“These are two separate discussions about developed country versus developing country. In majority of the developed countries where we operate, you see an aging population that is expected to outlive their retirement savings. We see this in Japan and Europe, for example, but what do people need when they age? It’s actually the medical bill that’s actually coming up, right?”

“So, they need additional support in medical insurance. If you live in the US, you have to have your own medical insurance. Yes, you have an insurance policy provided by the company, but when you reach your retirement age, and then you get off that company insurance policy — you have to buy your own policy.”

“And as you age and need additional funding for advanced medical technologies (ex. cancer treatment or heart attack prevention) for you to actually live longer, that can become very expensive as well.”

Image Source: Morning Consult

“And for countries like China, India, and Indonesia (including African nations), they do have some of the biggest population size on the planet, a growing population, and arguably a broad segment of younger population – so they will become global growth contributors in the future. I see that in 10 years’ time, the need for other types of insurance aside from life insurance will increase for this segment much in the same way that we have seen in developed countries like Japan where any given individual can actually have four or five different types of insurance,” Mouri forecasts.

A shift to preventative risk management

Another trend that Mouri sees is how insurance companies redesigns their services for their customers – both on the individual and organizational side.

“We will be seeing insurance companies promote the preventative activities for incidents especially for customers that are part of the aging population cohort. And technology and data will play a part in that transition.”

“Wearing devices to check pulse, transmitting that information to a database, and interpreting this data to know exactly policyholder’s medical condition is one example.”

“So, if we see something spiking in their vital sign, we actually let the customers know that, and advise them to better go check with a doctor to find symptoms earlier. Because it’s always better to treat symptoms earlier than wait till it becomes too late.”

“Another application is telematics such as the use of embedded technology in automobiles.”

A “black box” telematics that measures how, when, and where you drive. Image Source: Daily Record

Many insurance companies still assess motor insurance risks based on static information such as car model / characteristics, drive profile such as age, gender, and driving history, and usage of the car.

“Today, the use of telematics allows us to get real-time information such as driving behavior (when they put the brakes and when they put the accelerator, etc.), mileage, time of the day, etc. So we use these data to better asses the risk profiles of drivers to determine what discount drivers get on the premium, and who should be charged more.”

“And this will actually extend over to many areas like cyber security because embedded data collection allows us to detect patterns in advance or things that are happening.”

“Homeowner insurance is another use case. We put sensors around the house to detect burglary or fire — so all of these are now data points that we can collect and connect,” Mouri adds.

More robust investment strategies

“Because, you know, life insurance companies actually collect all the premiums, and they invest. And then they receive return form their investment. If they pay claims less than the sum of received premiums, investment return and their operating cost, they make money. But right now, they’re struggling because the interest rate is so low. Many established insurance companies have policies that guarantees returns of 4% or 5%, and those insurance companies struggle to find investment returns like that these days. But the insurance companies still have those contracts for another 30 to 40 years unless, policyholders actually get out from those policies or they die,” he explains.

When it comes to managing profitability, Mouri explains that there are only three levers a life insurance company can pull.

“You can increase the premium, increase the investment profit, or decrease the cost.”

”So, they do actually have to find a different way to make money in that space. And I think they're trying to do first (increase the premium) and then the third (decrease the cost) is because there isn't much they can do about the second. So that's a life insurance company in the near future.

Naohiro MouriExecutive Vice President and Chief Auditor at AIG

“And in general, there’s also consolidation that is going to happen given the maturity of the industry. I think Japan is yet to be there, but in Asia, there are new players that are buying up lots of insurance companies and consolidating them, allowing them to have the scale.”

Aspiring students

For new talents that want to be part of the industry, Mouri’s advice is:

“Digital capability is a must. Thinking outside the box is also important because the real world is not like being in a school where you will have one answer. You have multiple answers, and then you need to decide which one is the right for the organization. So ability to read context and reason logically is very important.”

“And then, you have to be flexible and adaptive because the change happens so quickly. I actually urge new students to really think deeply about what are the issues.”

“Then I would ask how you would solve those issues in a different way than what’s currently in place?”

“And expose yourself to all kinds of social issues, which is actually relevant to yourself because insurance companies deal with everything that’s happening around the world.”

“Whether its catastrophic events or political events like the George Floyd incident, they actually do have impact to insurance company because they could potentially result to the destruction of shops that are being insured. And if banks are forced to close, that’s business interruption that may be insured. So, anything and everything that happen around the world, you need to know what it means to thebusiness,” Mouri concludes.